Cybercrime Across the U.S.

Published 10/07/2022

Originally published by ThirdPartyTrust here.

Originally published by ThirdPartyTrust here.

Written by Chris Gerben, VP of Marketing, ThirdPartyTrust.

Many of us are spending more time on the internet, and technology has taken over how we work, interact with our friends, and even how we pay for goods and services.

But spending more time online means Americans are more susceptible to falling victim to cybercrime. Cybercrime is defined as any malicious activity done via a computer or the internet, such as email scams and identity theft.

The FBI tracks and fights cybercrime in the U.S. We wanted to know which states have the most victims, and how much money on average victims in each state have lost to cybercrime.

We also surveyed over 1,000 Americans to find out if they’ve ever personally been a victim of a cybercrime, or if they know anyone who has. The results reveal how much money Americans have lost to scams, and if they’ve reported it to authorities.

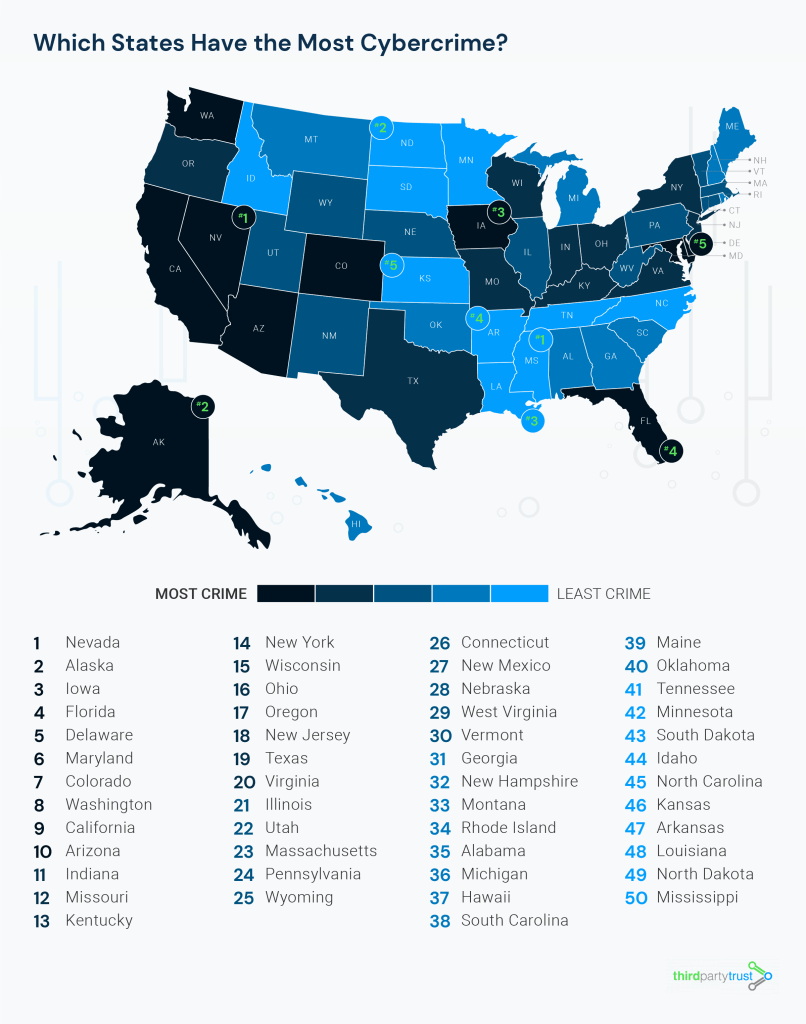

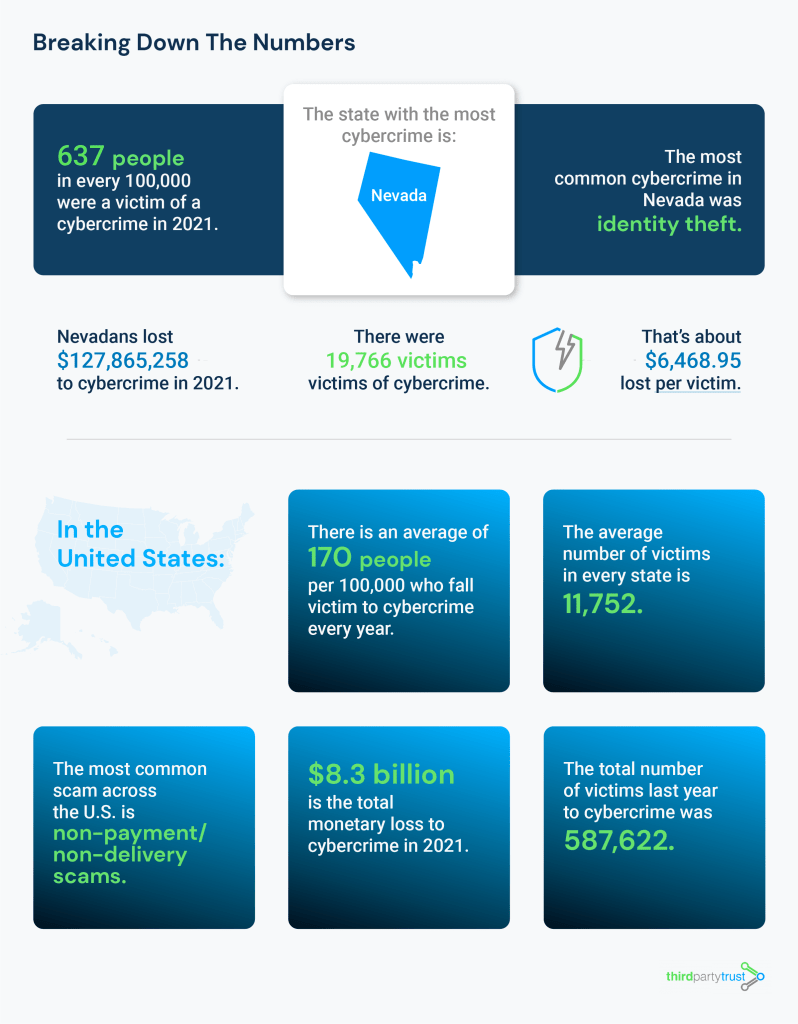

The state with the highest number of cybercrime victims per capita is Nevada. 637 people out of every 100,000 in Nevada have been a victim of a cybercrime – the average across the entire U.S. is 170 out of every 100,000 people.

The most common type of online crime in Nevada is identity theft. Altogether, there were 19,766 victims of internet crimes last year who lost a combined amount of $127,865,258. So if you’re planning a Vegas weekend getaway – make sure you take extra care not to fall victim to an internet scam.

Alaska ranks 2nd for the most cybercrime victims per capita, followed by Iowa (3rd), Florida (4th), and Delaware (5th). The states with the lowest cybercrime victims per capita are Mississippi, North Dakota, Louisiana, Arkansas, and Kansas.

If you think cybercrime isn’t costing Americans, think again. Over $8.3 billion was lost to cybercrimes just in 2021, and the most common scam was non-payment/non-delivery scams. This type of scam involves selling or buying something online, but the goods or money are never delivered.

There were a total of 587,622 victims of cybercrimes last year, averaging about 11,752 per state. It’s also important to remember that these are just the figures that are reported to the FBI, and the true number could be much higher.

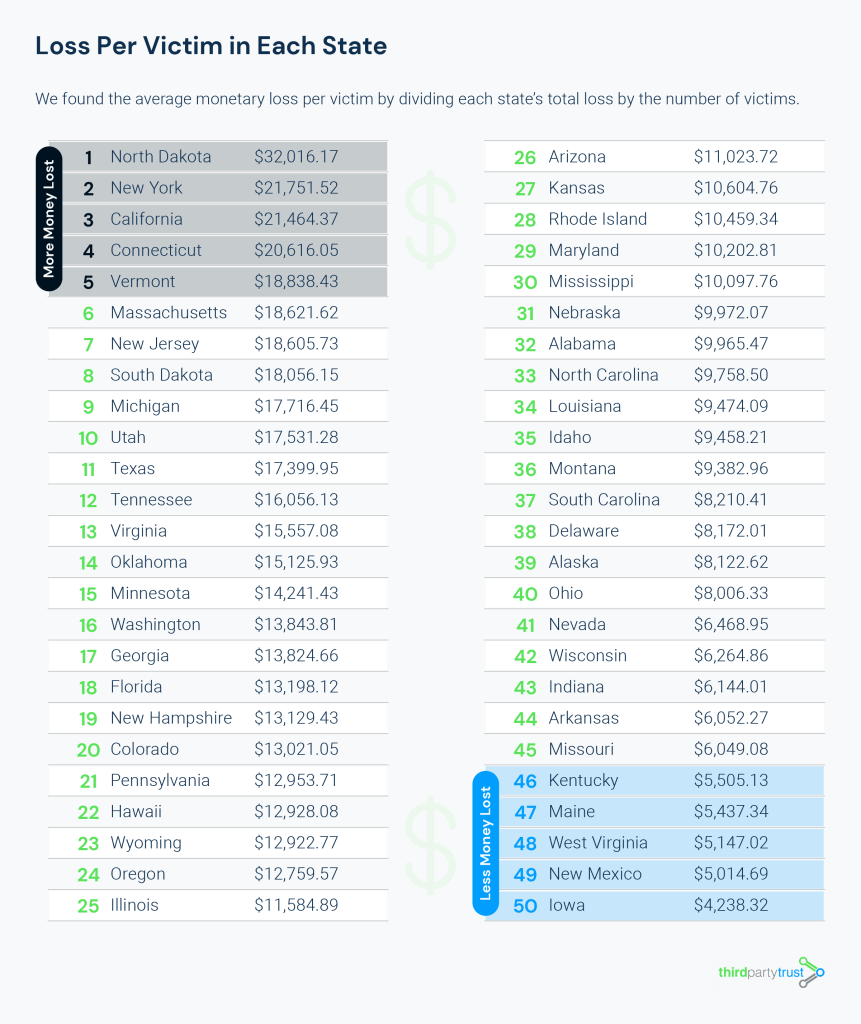

We also wanted to know how much money per victim was lost to cybercrime in every state by comparing the total monetary loss to the number of victims.

Those in North Dakota lost the most money per victim, with each victim losing approximately $32,016.17 on average to cyber criminals. Next (2nd) is New York, where victims lost an average of $21,751.52 each. Californians (3rd) lost $21,464.37, and those in Connecticut (4th) lost $20,616.05 on average. Those in Vermont (5th) lost $18,838.43 each on average.

While cyber criminals have made off with a lot of money across the U.S., they haven’t gotten away with as big of a haul in certain states. Those in Iowa lost only $4,238.32 on average. New Mexico, West Virginia, Maine, and Kentucky all lost less than $6,000 each per victim.

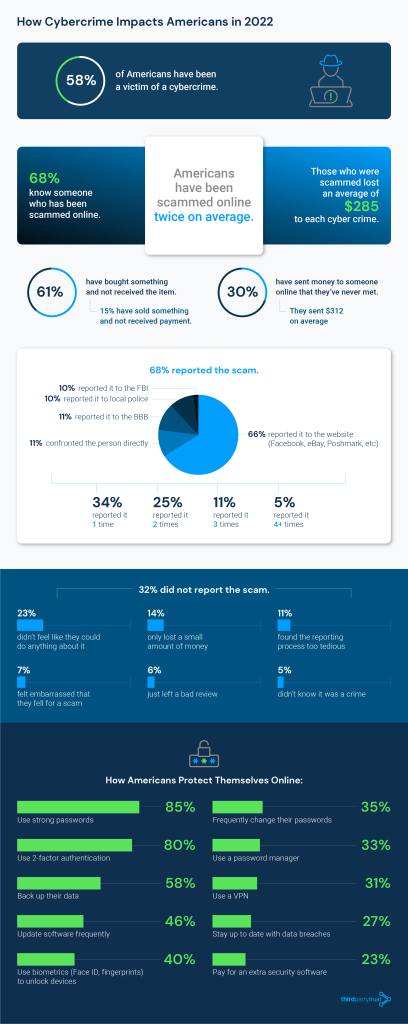

We wanted to dig deeper into cybercrime and ask Americans about their experiences with it. In a survey of over 1,000 Americans we found just over half (58%) have been a victim of a cybercrime, and 68% know someone who has been scammed online.

When it comes to non-payment/non-delivery scams, 61% have bought something online and not received the item, and 15% have sold something and not received a payment.

Those who have been scammed lost an average of $285 each. Almost 1 in 3 (30%) have sent money to someone online who they’ve never met in person, and they spent $312 on average. The number of times most Americans have fallen victim to a scam is twice.

So, online scams are clearly common. But that doesn’t mean there isn’t anything you can do about it.

When asked if they reported the scam, most (65%) reported it to the website they were scammed on (e.g. Facebook, eBay, Poshmark, etc.), 11% confronted the person directly, 11% reported it to the Better Business Bureau (BBB), 10% reported it to local authorities, and 2% reported it to the FBI.

Almost 1 in 3 (34%) Americans reported it once. 1 in 4 (25%) reported the scam twice, 11% three times and 5% reported it four or more times.

However, almost one third (32%) did not report the scam at all. The most common reasons they didn’t report the scam are that they thought there wasn’t anything they could do about it (23%), they only lost a small amount of money (14%), they found the reporting process to be too tedious (11%), they felt embarrassed they fell for a scam (7%), and they didn’t know it was a crime (5%).

While this all may sound bleak, there are ways to protect yourself online. When asked what they do to protect themselves, Americans say they back up their data regularly (58%), pay for extra security software (23%), use two-factor authentication (80%), use strong passwords (85%), use a password manager (33%), and use a VPN (31%). Other ways they protect themselves online include staying up to date with data breaches (27%), frequently changing their passwords (35%), updating their software frequently (46%) and using biometrics to unlock devices like fingerprints and Face ID (40%).

Cybercrime is everywhere, but there’s things you can do to protect yourself and lessen the chance of losing money. Do not ever send money to someone online that you haven’t met in person. Remember to use strong passwords, and change them frequently. Most importantly: remember that it is a crime that you can and should report to the FBI.

Methodology

We used data from the FBI’s 2021 Internet Crime Report (most up-to-date at the publishing of this report) to find the number of reported incidents by state. We combined this with US Census Bureau’s population estimates to find the number of crimes per 100,000 residents.

In August 2022, we surveyed 1,001 Americans about their experiences with cybercrime. Respondents ranged in age from 18 to 76, with an average age of 37 years old. They were 49% male, 48% female, and 3% transgender/non-binary.

Unlock Cloud Security Insights

Subscribe to our newsletter for the latest expert trends and updates